How to Choose Between Plaid and Salt Edge?

- Nishant Shah

- Jul 26, 2023

- 4 min read

Updated: Oct 17, 2024

As financial technology continues to rapidly evolve, companies are seeking new and innovative ways to integrate financial data into their products and services. Plaid and Salt Edge are two companies that provide solutions for accessing financial data and account information. We will compare and contrast Plaid vs Salt Edge to help you determine which one might be the better choice for your business needs.

Similarly, we have compared Plaid vs MX.

Both Plaid & Salt Edge are categorised as Account Aggregators.

Account Aggregators (AA) are financial entities that provide financial data aggregation services by collecting, organizing, and presenting data from multiple sources in a single place. Here are some of the use cases for Account Aggregators:

Personal finance management: Account Aggregators allow customers to view and manage their financial accounts in one place, providing a comprehensive view of their finances. This enables customers to track expenses, monitor cash flow, and set budgets more efficiently.

Credit assessment: Account Aggregators can help lenders and financial institutions to assess the creditworthiness of their customers by providing a detailed view of their financial position. Lenders can make informed decisions by analyzing the customer's credit history, spending habits, and cash flow.

Financial advisory: Account Aggregators can help financial advisors to provide more personalized and effective financial advice to their clients. Advisors can analyze their client's financial position and recommend suitable investment options, taking into account their financial goals and risk appetite.

You may also like to check our FinTech API Discovery. This covers important APIs in KYC, AML, eSigning, Investment, Banking, and other financing services.

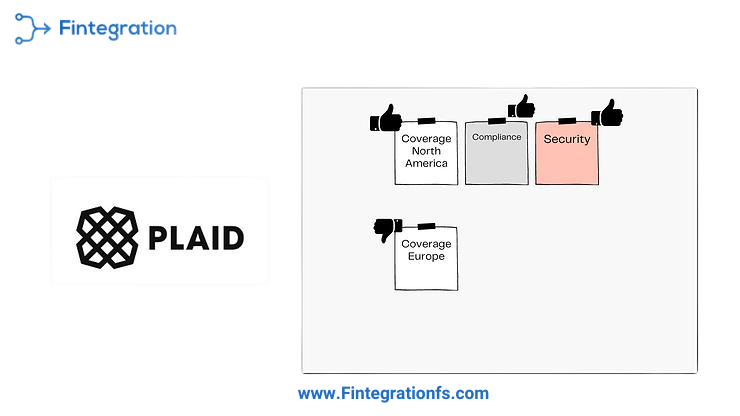

Plaid is a leading provider of financial data access tools. The company offers a suite of APIs that allow developers to access financial data from more than 11,000 financial institutions in the US and Canada. Plaid provides a simple way for developers to access account information, transaction history, and other financial data, making it a popular choice for fintech startups and established financial institutions alike.

Here are some of the key services plaid offers:

Plaid Connect: This is Plaid's flagship product, which provides a simple and secure way for businesses to connect to their customers' bank accounts. It allows for account verification, balance checks, and transaction history retrieval .

Plaid Exchange: This offering allows financial institutions to securely exchange data with one another, enabling real-time account verification and enabling the creation of more personalized financial products and services.

Plaid ACH: Plaid provides an ACH Transfer feature. This is one of the most recent offerings in the money movement space.

Plaid API: A set of developer tools that allow businesses to build custom financial applications and services. The API provides access to a wide range of financial data, including account balances, transaction history, and more.

Plaid Link: A pre-built authentication flow that allows businesses to easily connect to their customers' bank accounts. It provides a secure and user-friendly experience that can be easily customized to fit a business's brand and user experience.

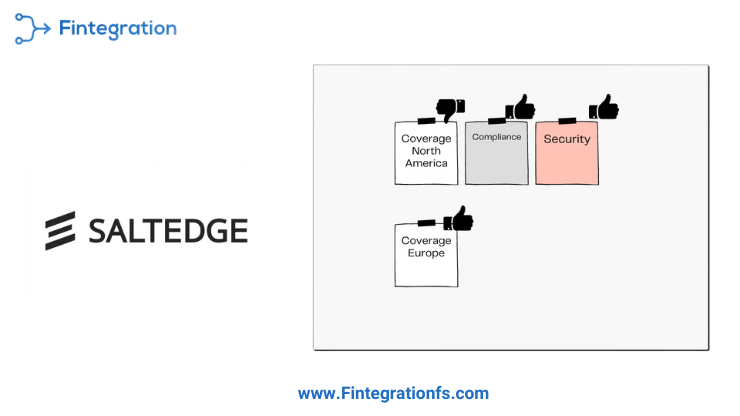

Salt Edge, on the other hand, is a European-based financial data aggregation company that offers similar services to Plaid. Salt Edge also provides APIs for developers to access financial data from a variety of sources, including banks, payment processors, and e-wallets. Salt Edge's platform supports more than 5,000 financial institutions across Europe, Asia, and the Middle East. Here are some of the key services Salt Edge offers:

Account Information Services (AIS): Salt Edge's AIS solution allows businesses to access the bank account information of their customers, enabling them to aggregate data from multiple accounts and banks in one place. This information can be used to provide a range of services such as financial planning, budgeting, and personal financial management.

Payment Initiation Services (PIS): Salt Edge's PIS solution allows businesses to initiate payments from their customer's bank accounts. This service can be used to facilitate e-commerce transactions, recurring payments, and other payment-related operations.

Data Enrichment Services (DES): Salt Edge's DES solution provides enriched data insights, categorization, and analytics on customers' transaction data. This helps businesses to gain a better understanding of their customer's spending habits, enabling them to offer personalized financial products and services.

Compliance Solutions: Salt Edge offers compliance solutions that help businesses comply with PSD2 and other regulatory requirements. This includes strong customer authentication, fraud detection, and monitoring tools.

Key Differences:

Coverage & Region: Plaid has coverage of 11000 financial institutions in North America. This means that if your business is primarily focused on North America, Plaid may be the better choice. Salt Edge supports for more than 5,000 institutions across Europe, Asia, and North America. This means that if your business is primarily focused on Europe or the Middle East, Salt Edge may be the better choice.

Compliance: Salt Edge's platform is designed to be highly customizable, with a range of tools and features that allow developers to create tailored financial data access solutions. Salt Edge also offers a suite of compliance and security tools that are designed to meet the needs of regulated financial institutions. Salt Edge is helping multiple banks with their PSD2 compliance.

Security: Both platforms have a robust security infrastructure. They provide end-to-end encrypted bank data & follow bank-grade security compliances.

Quick summary, understand your use case & apply for a right partnership. Our team at FintegrationFS can help you select right partner. Please schedule a call.