How to Create a Secure and Efficient Payment Gateway?

- Arpita Maharishi

- Jan 24, 2024

- 8 min read

Updated: Jan 31, 2024

Table of content

What is a payment gateway?

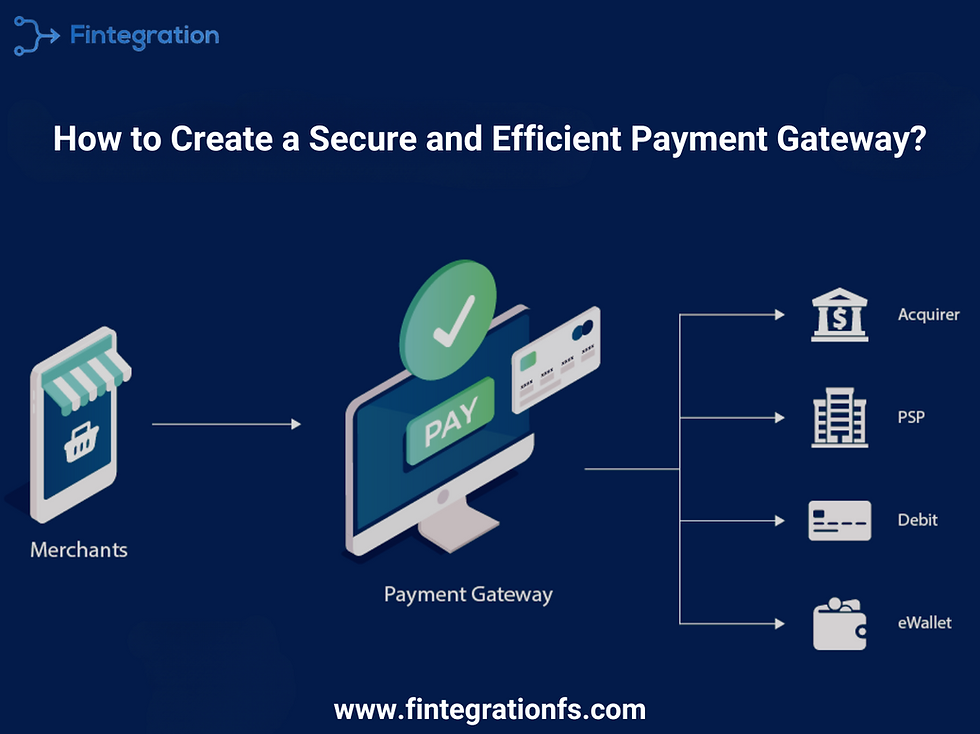

Payment gateways act as bridges, enabling merchants to accept online and offline debit and credit card payments from customers. Sitting at the heart of the payment processing ecosystem, payment gateways seamlessly connect a customer's bank and a merchant's account, ensuring smooth funds transfer.

Payment gateways perform crucial functions:

Encryption: Protecting sensitive payment information from unauthorized access or theft during transmission between the customer's device, the business's server, and the financial institutions.

Transaction Authorization: Verifying the transaction details, checking the customer's account balance, and validating the payment information.

Fraud Detection: Employing security measures such as encryption protocols (SSL or TLS), fraud detection algorithms, and address verification systems (AVS) to prevent fraudulent transactions and protect payment information.

Integration: Ensuring seamless integration with the merchant's website, app, or POS system.

Key Features of Payment Gateway Development

In the grand symphony of online commerce, payment gateways play a critical role. These digital maestros quietly conduct the flow of funds between customers and merchants, ensuring a smooth, secure, and harmonious shopping experience. Their importance resonates throughout the digital realm, for they:

1. Seamless Checkout Process: Forget clunky checkout symphonies riddled with endless forms and frustrating delays. Payment gateways offer a concise score, where:

Elegant one-click movements: Pre-saved payment options and lightning-fast purchases minimize checkout time, keeping customers engaged.

Diverse melodic instruments: From classic credit cards to modern digital wallets and regional harmonies, gateways cater to a variety of payment preferences.

Mobile-optimized concertos: Seamlessly integrated with mobile platforms, they adapt to the on-the-go tempo of modern shopping.

2. Encryption and Fraud Detection: With cyber threats lurking like discordant notes, trust is the key signature of online transactions. Payment gateways provide a fortified orchestra pit, featuring:

Encrypted Fortes: Sensitive data like credit card details dance behind a wall of end-to-end encryption, safeguarding against unauthorized intrusions.

Fraud-detecting counterpoint: Sophisticated algorithms and real-time monitoring systems act as vigilant music critics, identifying and silencing fraudulent transactions before they disrupt the flow.

Regulated Harmony: Adherence to strict security standards like PCI-DSS ensures data privacy and protects the rhythm of commerce.

3. Convenience and Faster Payments: By prioritizing security and convenience, payment gateways subtly amplify the melody of customer satisfaction, leading to:

Strengthened customer bonds: A smooth checkout performance builds trust in the merchant, encouraging customers to return for encores.

Reduced cart abandonment blues: Minimized friction during checkout keeps customers happily singing along, translating to higher conversion rates and sales.

Loyal fan base: Positive experiences create a harmonious chorus of brand loyalty, attracting and retaining customers in a competitive marketplace.

4. Conduct Global Symphonies: No longer confined by geographical borders, payment gateways unlock a world of opportunities for merchants, allowing them to:

Accept melodies from all corners: Multi-currency transactions let merchants expand their audience by welcoming payments from across the globe in various currencies.

Localize the tune: Cater to specific regions with localized payment methods and languages, offering a culturally relevant experience.

Break free from regional restrictions: With the complexities of international payment systems silenced, merchants can reach diverse markets and conduct a truly global symphony of commerce.

Types of payment gateway

Selecting the ideal payment gateway for your e-commerce venture is akin to finding a path through a complex labyrinth. This guide is designed to be your guiding light, illuminating the different types of gateways available and their distinct features, to ensure your path to successful and efficient online transactions is clear and straightforward.

Hosted Gateways

Hosted gateways are external services offered by third-party providers. They are the most user-friendly option for business owners. When customers make a purchase, they are directed to a secure external page managed by the service provider, where transaction data is securely processed and sent to the bank.

Pros:

Easy to set up, reducing technical burdens.

Integrates effortlessly with your site, allowing you to concentrate on your business.

Cons

Less control over the payment process, akin to delegating important decisions.

Often comes with higher fees, which may impact your profits.

Self-Hosted Gateways

In contrast, self-hosted gateways are embedded directly within your website or application. This option gives you complete oversight over the transaction process but requires greater technical knowledge and regular upkeep.

Pros:

Total control over the payment experience, tailoring it to your brand.

Typically involves lower fees, benefiting your bottom line.

Cons:

Demands significant technical skill and adherence to security standards.

Requires ongoing maintenance, which can be demanding.

API-Hosted Gateways

API-hosted gateways, which utilize application programming interfaces, strike a balance between integration and ease of use. They offer a degree of customization and require some technical skill, but are generally less demanding than fully self-hosted solutions.

Pros:

Offers a customizable payment experience.

Requires less technical skill than fully self-hosted gateways.

Cons:

Limited customization compared to fully self-hosted options.

Some technical knowledge is still necessary.

Local Bank Integration

Finally, local bank integration gateways link your e-commerce platform directly with a local bank's payment system. This option provides a highly secure and streamlined payment process but may be less versatile in terms of international transactions and payment methods.

Pros:

Deep integration with local banking systems for a seamless experience.

Lower fees for local transactions can be more economical.

In-depth knowledge of local regulations provides a solid foundation.

Cons:

Limited scope for international transactions.

Potential challenges in accommodating various payment methods.

Complex setup and integration requirements.

Pros and cons of creating a custom payment gateway versus using a third-party solution.

When it comes to payment gateways, businesses have two options: creating a custom payment gateway or using a third-party solution. Here are the pros and cons of each:

Custom Payment Gateway

Pros:

Full control over the payment process, including branding and user experience.

Custom features tailored to the business's unique needs.

Potential to sell payment gateway services to other companies for additional revenue.

Cons:

Considerable setup costs, including all required certifications, developer fees, and audits.

Lengthy setup time between development, UX testing, and ongoing maintenance.

Requires more manpower and technical expertise.

Third-Party Payment Gateway

Pros:

Minimal setup and technical complexities.

Seamless integration with the website or app.

Lower transaction fees compared to custom payment gateways.

Established security measures and compliance with regulations.

Cons:

Limited control over the payment process, including branding and user experience.

Limited customization options.

Potential for higher transaction fees compared to self-hosted payment gateways.

Considerations for compliance with regulations such as GDPR and PCI DSS.

In today's data-driven world, safeguarding sensitive customer information is paramount. This journey often brings us face-to-face with complex regulations like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). But fear not, intrepid data guardians! Here's a roadmap to navigate these regulatory landscapes with confidence:

General Data Protection Regulation (GDPR):

Understanding the Scope: GDPR casts its net wide, encompassing businesses operating within the EU and those handling personal data of EU residents. Mapping your data flows and identifying applicable regulations is crucial.

Sailing with Lawful Basis: Every data processing activity needs a valid justification. Familiarize yourself with the six GDPR-approved bases and steer clear of murky waters.

Empowering Data Subjects: Respecting individual rights is key. Ensure transparency, access, rectification, and erasure mechanisms are readily available for your passengers.

Building Secure Strongholds: Fortify your data with appropriate technical and organizational measures. Encryption, robust systems, and data resiliency are your unwavering sails.

Payment Card Industry Data Security Standard (PCI DSS):

Secure Networks: Maintain firewalls, intrusion detection systems, and secure configurations to guard cardholder data like precious treasure.

Protecting the Data: Encrypt at rest and in transit, restrict access to authorized personnel, and update security systems like a vigilant crew.

Vulnerability Management: Regularly identify, assess, and address vulnerabilities to keep your systems shipshape.

Access Control Measures: Define roles, track access, and enforce strong passwords to prevent unauthorized boarding.

Testing and Monitoring: Conduct regular scans and monitor system activity to proactively identify and address potential breaches.

Integrating fraud detection tools in your payment gateway

Integrating fraud detection tools in a payment gateway is essential to protect businesses from fraudulent transactions.

Built-In Fraud Prevention Tools: Payment gateways and acquirers offer built-in fraud detection tools as part of their services. However, there can be a conflict of interest as these tools are designed to accept the payment, potentially leading to compromised fraud prevention

Credit Card Fraud Detection: Payment gateways with built-in fraud prevention tools help identify transactions that don't meet set rules and flag or block potentially fraudulent transactions. These tools are crucial for preventing large transactions with stolen card information and maintaining chargeback rates within acceptable limits

Risk Scoring Tools: Risk scoring tools, based on statistical models, are used to identify fraudulent transactions. It is important to ensure smooth integration of the payment gateway with the current platform to avoid errors and maintain a seamless customer experience

Advanced Fraud Prevention Strategies: Advanced strategies for preventing payment gateway fraud include technologies such as card verification value (CVV), IP fraud scoring systems, and data enrichment to assess and minimize the risk of fraudulent activities

Payment Gateway API: Integrating a secure and reliable payment gateway API with fraud prevention measures is crucial for processing online transactions securely and efficiently

Average time required for developing a basic vs. advanced payment gateway.

A basic payment gateway with few features and payment choices takes several months to construct on average. Nonetheless, it may take up to a year or more to obtain a more advanced and feature-rich payment gateway that supports numerous payment methods, foreign currencies, cutting-edge security measures, and complies with numerous regulatory criteria.

Various factors, including the payment gateway's complexity, team expertise, desired functionality, and required level of integration, can impact the development duration of the system. In addition, developing a payment gateway requires more time than integrating a third-party solution, especially when custom features are involved. To speed up this process, it is advised to engage with development teams with experience.

Strategies for a successful launch.

Research and Preparation: Engage in detailed market analysis, understanding user behavior, and scrutinizing product-specific requirements. Focus on identifying your target demographic, adhering to local and regional regulations, and accommodating different transaction types and currency options.

Building the Payment Gateway Framework: Develop a strong, scalable infrastructure tailored to your payment gateway’s needs.

Clarifying Business Objectives: Prioritize a clear understanding of your specific business requirements before embarking on the development of a payment gateway.

Testing and Implementation: Conduct extensive testing to validate the security, reliability, and effectiveness of your payment gateway in meeting business objectives.

Following successful testing, proceed with the launch, enabling your business to start processing customer payments.

Monitor and Maintain: Commit to continuous monitoring and regular maintenance of your payment gateway. This process should include regular updates, incorporating new features, enhancing security protocols, and promptly addressing any technical glitches or issues.

Upcoming technologies in the payment industry

New technologies are continually being developed to enhance the payment experience for both customers and merchants in the ever-evolving payment sector.

1.Blockchain Technology: The payment business is transforming thanks to this quickly developing payment trend. Popular cryptocurrencies like Ethereum and Bitcoin are setting the standard for blockchain-based payment systems.

2. Digital Currencies: Another noteworthy development in the payment sector is the increasing usage of digital currencies. For consumers and retailers alike, digital currencies provide a simple, safe platform to access and use.

3. Embedded Finance: The integration of financial services with non-financial goods and services, like e-commerce websites and mobile applications, is known as embedded finance. In the upcoming years, it is anticipated that this trend will continue to increase, offering customers more easy and convenient payment options.

4.New Payment Methods: As the payment sector continues to develop, new payment options are appearing. Examples of these include mobile payment apps and buy-now, pay-later options.

5. Payment Industry Trends to Watch: One further development to keep an eye on is the growing need for payment customization. Whether paying in-person or online, customers want a smooth experience, therefore businesses are concentrating on making payments safe and tailored to them.

FAQ's

1.) How can I ensure the security of my Payment Gateway?

To ensure security, use encryption technologies like SSL (Secure Socket Layer) for data transmission. Implement PCI DSS (Payment Card Industry Data Security Standard) compliance to safeguard cardholder data. Additionally, use tokenization and fraud detection tools to protect against unauthorized transactions.

2.) Are there any specific legal considerations when setting up a Payment Gateway?

3.) How can I optimize the transaction success rate with my Payment Gateway?

4.) Can I integrate advanced technologies like AI and blockchain in my Payment Gateway?